Remaking Made in India will be a long slog

India will need to work closely with the world's second-largest economy to achieve its own manufacturing dreams.

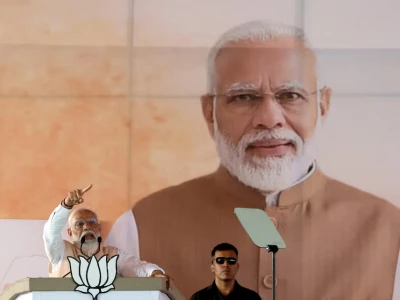

MUMBAI, April 19 (Reuters Breakingviews) - India’s $24 billion plan to become a rival to China's factory for the world builds on the South Asian nation's subsidies and cheap labour. Yet the production-linked incentive (PLI) scheme unveiled in 2020 is losing shine after a soaring start. If Prime Minister Narendra Modi is re-elected, his flagship initiative to create jobs and support self-sufficiency will probably get an overhaul.

The PLI pays subsidies to manufacturers based on their output and on capital spending in sectors like semiconductors. Such outlays helped quadruple mobile exports in three years. Smartphone manufacturing is enough of a success for Modi to trumpet India’s position as the second-largest handset maker in his Bharatiya Janata Party's manifesto for elections that start on Friday.

Shoppers in main markets like China and Europe are tightening their purse strings, while fast fashion giant Shein is rapidly selling cheap tops and shoes.

More Indians buying iPhones supports the presence of Apple’s contract manufacturers Hon Hai Precision Industry Wistron and Pegatron in the country, all of whom signed up for the scheme. Yet there are worrying signs that what worked for data-enabled communication devices may not for the 13 other sectors targeted by the scheme.

True, India has reduced its external dependence on medical devices, cutting, opens new tab net imports for the first time in 2023. Investments in some other industries like automotive components and batteries are in the early days of the scheme, making success harder to judge. Yet despite starting payouts in eight, opens new tab sectors, a mere 4% of the allocation has flown to industry so far.

Firms in some sectors are too small to qualify for the bounty. Take textiles. Over 60%, opens new tab of Indian fabric exports come from small mechanised looms scattered across the country. The subsidies on offer are for man-made fibres and technical textiles, which require investments in large industrial parks by companies with links to global value chains.

High tariffs on inputs are a dampener, too. The administration is caught between using duties to curb inflows of Chinese components required to build solar modules and making local production cheaper. A similar tension was at play last year when India aborted its attempt to regulate laptop imports; Chinese components have accounted for 57%-100%, opens new tab of the country's solar imports since 2021, per BloombergNEF. So it may not be enough even if officials lower, opens new tab duties.

Global manufacturers might be more willing to sign up to the scheme if they know they can source components cheaply and from across the border. Despite India’s move to fast-track visas for Chinese nationals in November, Xiaomi complains that heavy scrutiny of companies based in the People’s Republic has made smartphone component suppliers wary of setting up production in the country.

India will need to work closely with the world's second-largest economy to achieve its own manufacturing dreams. That, though, may be easier to admit after the elections when politicians can tone down the nationalist and protectionist rhetoric.

Apple has assembled iPhones worth $14 billion in India in fiscal 2024, Bloomberg reported on April 10, citing unnamed people familiar with the matter.

India has paid $1.02 billion as incentives under its production-linked incentive scheme to boost local manufacturing, following over $13 billion in investments from private firms, Rajesh Kumar Singh, secretary at the country’s Department for Promotion of Industry and Internal Trade, told Reuters on April 4. The total allocation for scheme is $24 billion.

The administration is mulling restructuring the PLI scheme in sectors with slow progress, and even scrapping it in sectors where investor interest is dim, India’s Mint newspaper reported, opens new tab on April 3.